Accounts Payable &

Accounts Receivable

Staying on top of AP and AR is critical for managing your cash flow and overall financial health.

Keep Money in Motion with Next-Level Digital Tools*

Utilize Striven to efficiently track debts, manage receivables, automate transactions, and unlock insightful analytics for effective cash flow control.

*Striven is developed and rigorously tested to be compliant with Generally Accepted Accounting Principles (GAAP).

Holistic Financial Management

Transform your AP/AR processes from manual, time-consuming tasks to automated, efficient workflows.

By proactively managing your payables and receivables, you not only optimize your cash flow but also gain deep insights into your financial health.

From improved accuracy in financial reporting to better relationships with vendors and clients, the benefits of Striven are multi-fold.

- Accounting Process Automation

- Integrated CRM

- Reporting & Analytics

- Compliance Management

- Scalability

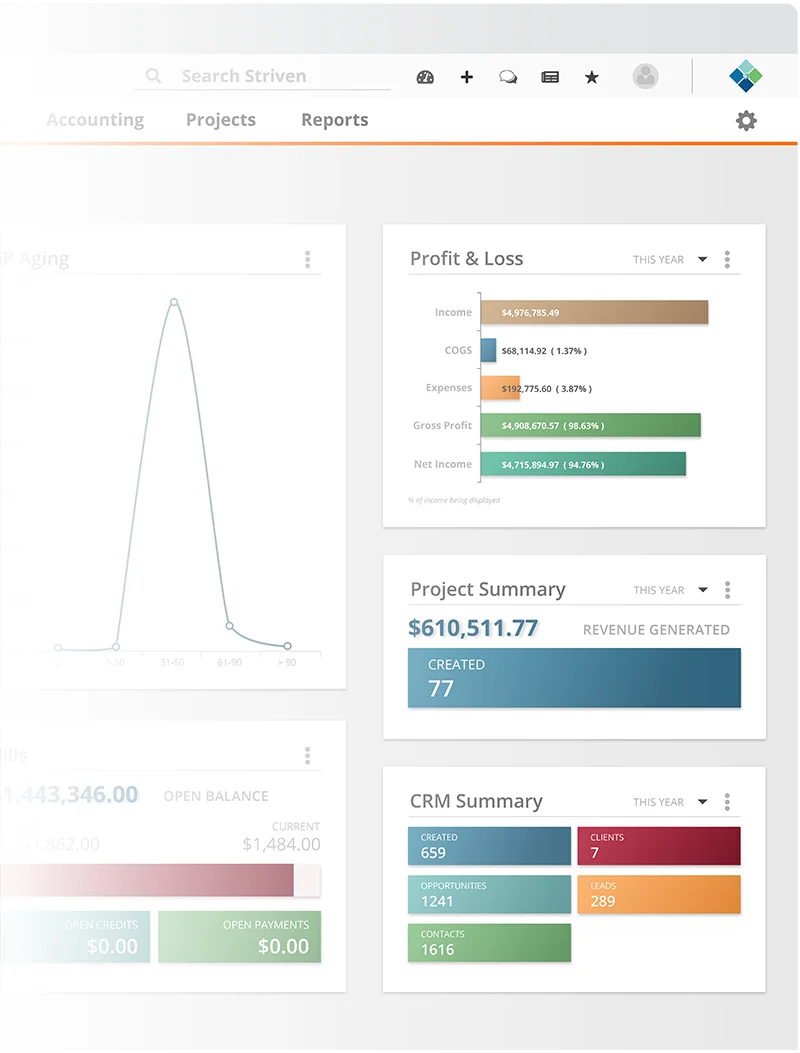

- Custom Dashboards

Take The Reins of Your Cash Flow

Streamline your operations, improve cash flow, and make more insightful business decisions.

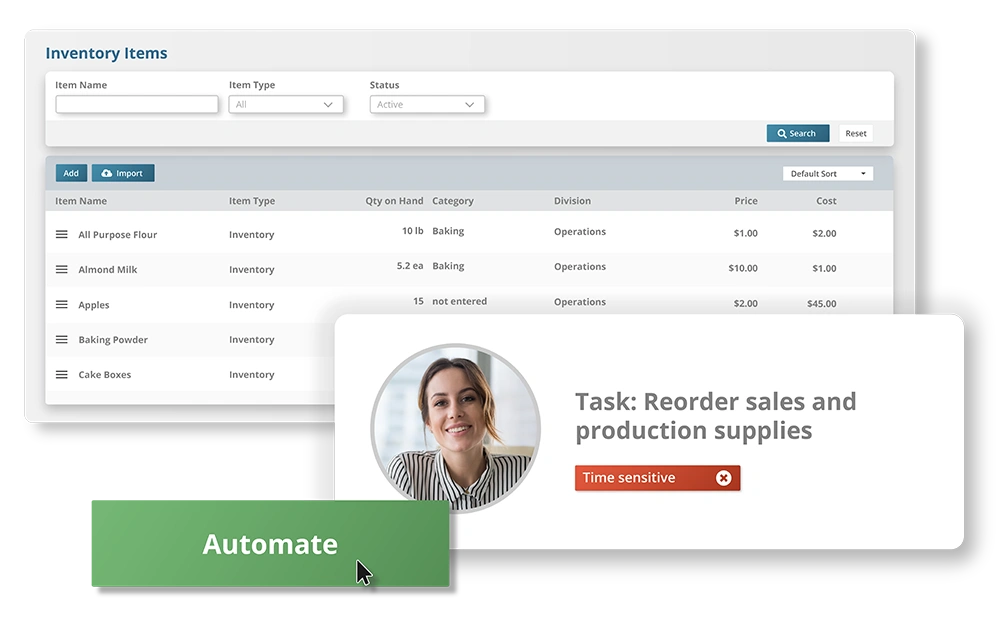

All of Your Accounts, Automated

Eliminate manual tasks and minimize errors with the automation capabilities of Striven.

From invoice generation to payment processing, accounting process automation speeds up operations, allowing your team to focus on strategic tasks.

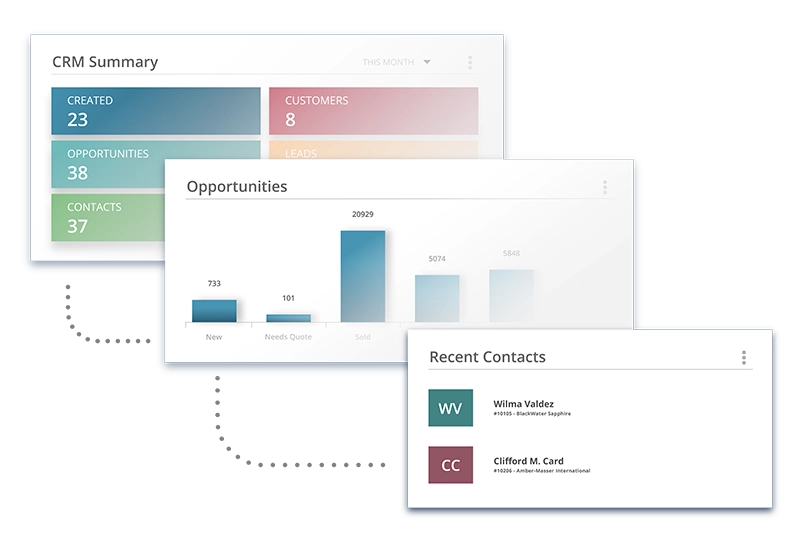

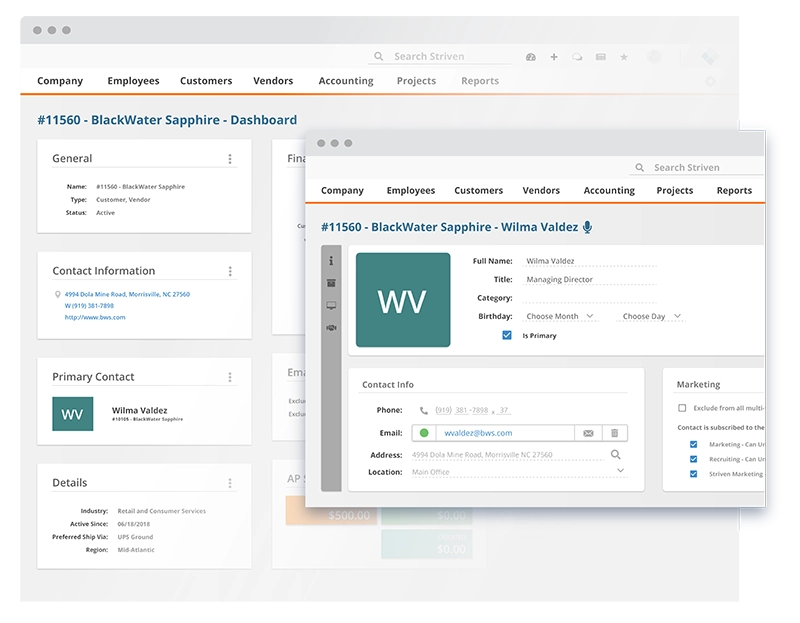

Integrated CRM

A unified view of customer/vendor interactions and payments can significantly improve communication, manage credit risk, and help your business provide better service.

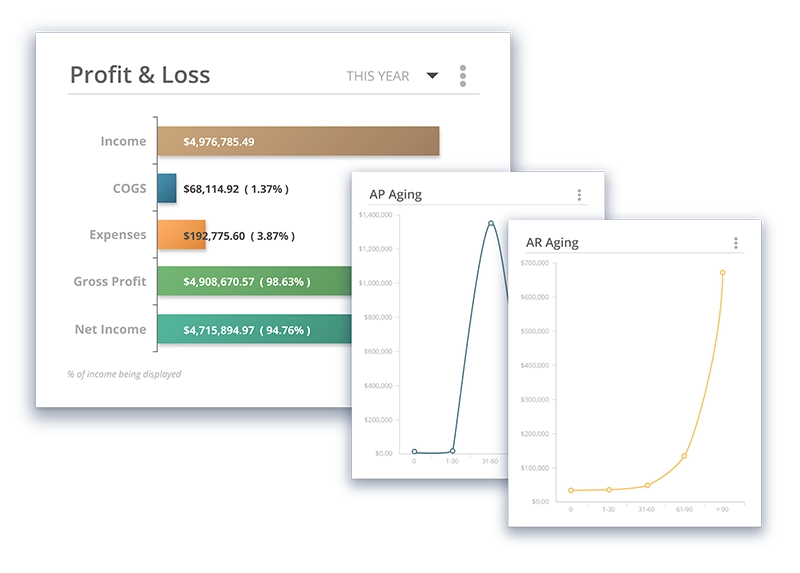

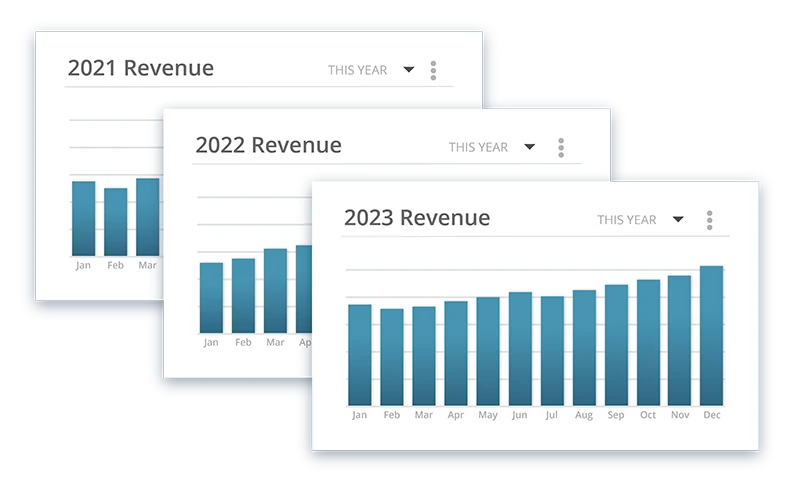

Make Data-Driven Decisions

Unlock the power of data with in-depth reporting and analytics about your AP & AR.

Visualize your financial status, track key metrics, and gain insights into payment trends to make informed business decisions and optimize cash flow.

Secure Compliance Management

Safeguard your business from potential legal issues with robust compliance management.

Striven’s AP/AR capabilities ensure adherence to financial and other regulations, providing peace of mind and protecting your company’s reputation.

Seamless Scalability

Keep pace with your growing business with business software that grows as you do.

As your operations expand, your software can seamlessly accommodate more users, transactions, and data, ensuring consistent performance no matter what your cash flow looks like.

Custom Dashboards

Tailor your view to highlight the inflows and outflows that matter most, improving efficiency and promoting a better understanding of your financial health.

“The ability to keep invoicing, PO’s, communications, and all linked to each order is priceless.”

“Our customers and vendors appreciate the convenience of access to their documents 24/7 as well.”

—John P., VP, Business Development

Video Testimonial

Tire Sales & Service

Phil D’Alonzo, COO of the TSS Group, discusses how Striven helped his company manage its cash flow. With real-time information, the company is now able to make decisions as swiftly as the industry moves.

Ready to try it? Start here.

Frequently Asked Questions

-

Can Striven automate invoice generation and payment processing?

+

Absolutely! Striven is designed to automate various financial tasks such as invoice generation and payment processing. This reduces manual workload and increases efficiency.

-

Is there an integrated CRM in Striven?

+

Yes! An integrated CRM feature is an essential part of a comprehensive AP/AR software. It helps improve customer relationships and manage credit risk by providing a unified view of customer interactions and payments.

-

What type of reports and analytics can I generate?

+

Striven provides in-depth reporting and analytics capabilities. You can visualize your financial status, track key metrics, analyze payment trends, and gain insights to make informed business decisions about your cash flow.

-

Can I generate custom Profit and Loss (PnL) reports?

+

Yes, Striven allows you to generate custom PnL reports. With this feature, you can gain better insights into your business’s financial health and make data-driven decisions.

-

Is Striven’s platform mobile-friendly?

+

Yes, Striven is fully optimized for mobile devices. This means you can manage your finances, transactions, and inventory anytime, anywhere right from your pocket.

-

Is Striven scalable as my business grows?

+

Yes, Striven is designed to scale with your business. As your operations expand, the software can seamlessly accommodate more users, transactions, and data.

-

Can I give my customers access to their invoices and billing information?

+

Yes! With Striven’s Portals, your customers, clients, contractors, and whoever else you need to give access to can easily view their invoices, make payments, and track their billing history, fostering transparency and trust.

-

How can Striven benefit my cash flow management?

+

Cash is King. By effectively managing payables and receivables, Striven helps optimize your cash flow. With a clear picture of your financial status, you’ll be able to make strategic decisions to improve cash flow.

-

Can Striven handle tax calculations and adjustments?

+

Absolutely! Our software has a comprehensive tax management system that can handle different tax rates, tax exemptions, and tax computations, saving you the hassle of manual calculations.

-

Can I customize the dashboards to suit my needs?

+

Absolutely! Striven allows you to personalize dashboards, tailoring your view to highlight the metrics that matter most to your business.

Striven's Got You Covered

Whatever your business, Striven is here for you, making your workweek just a little easier.