Transaction Management

Document, analyze, and learn from every transaction.

Magnify Your Growth

Striven’s transaction management system is engineered to refine accuracy and flexibility, not just through its design, but by incorporating direct feedback mechanisms and real-time data analytics.

- Payment Processing

- Audit Trails

- Error Handling

- Tax Management

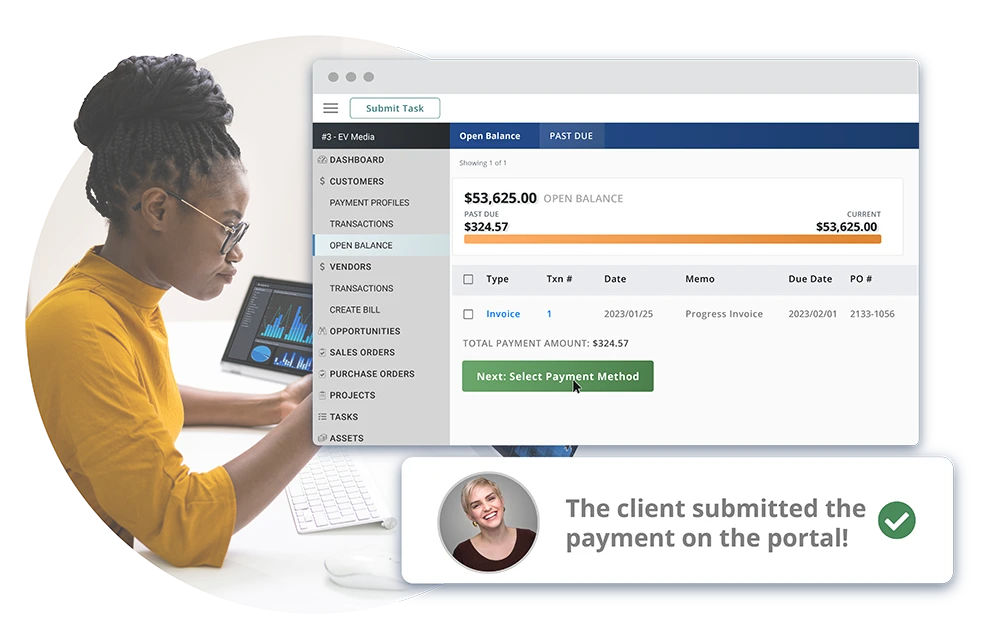

Payment Processing

Striven facilitates a variety of payment methods, leveraging online banking integrations and automated processing for both inbound and outbound transactions.

This not only simplifies the user experience but also ensures that funds are managed efficiently, liquidity is maintained, and payments are processed securely

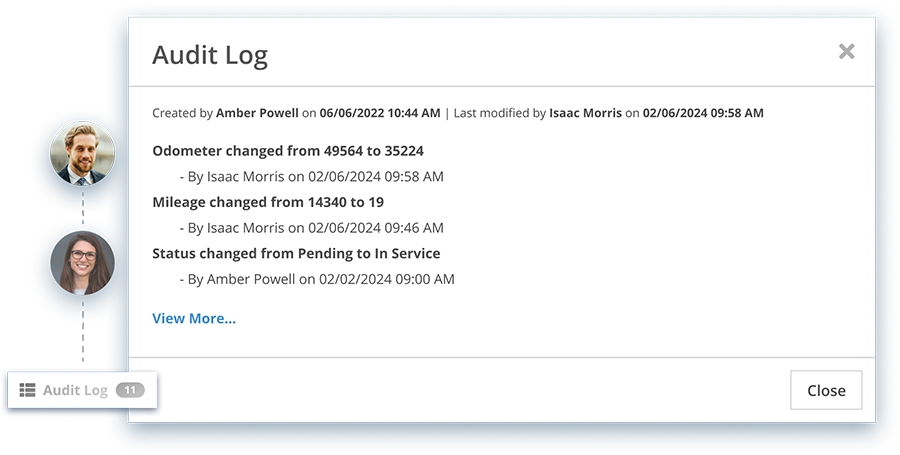

Audit Trails

With a comprehensive digital ledger, every modification, entry, or deletion within the system is logged with precision.

The real-time alerts and compliance reporting functionalities are not just features; they’re safeguards that ensure your data’s integrity and your operation’s accountability.

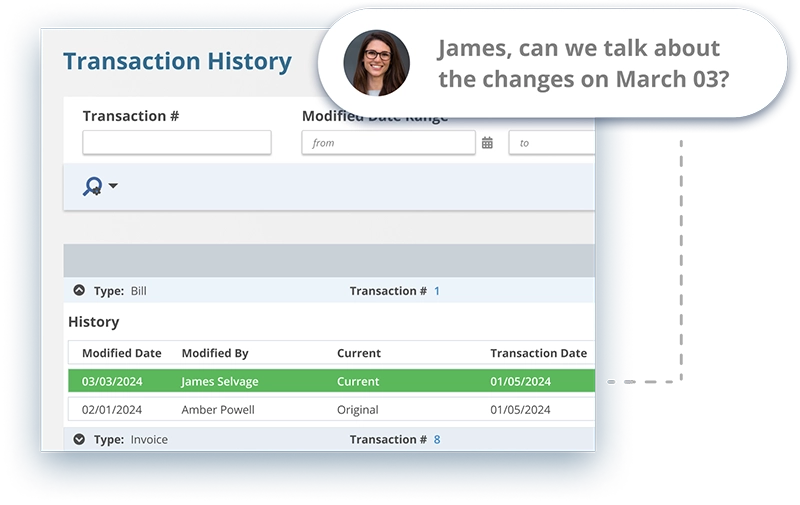

Error Handling

By automating the detection and notification of discrepancies, our system proactively identifies and addresses errors.

This preemptive approach not only reduces the manual labor involved in spotting errors but also minimizes the risk of financial discrepancies affecting your bottom line.

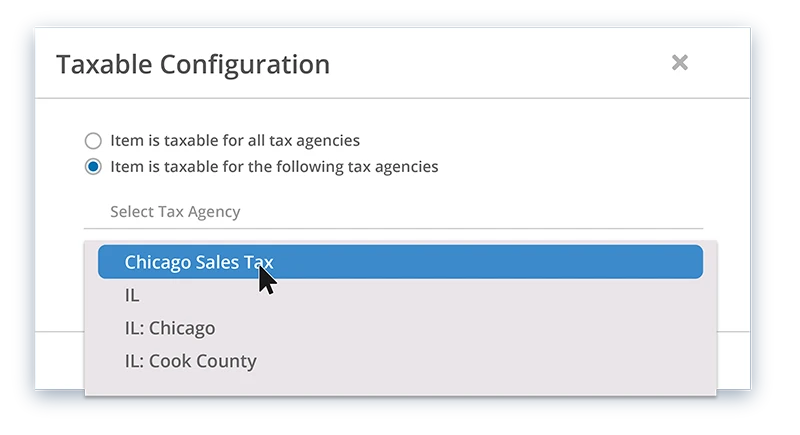

Tax Management

Navigating the complexities of sales tax is streamlined through our customizable tax agency settings.

Whether dealing with state, city, or other tax types, our system allows for accurate collection, reporting, and payment of taxes.

“Striven is a great alternative to QuickBooks.”

“Unlike QuickBooks, Striven has a great customer service support team to help with your setup and any future needs.”

—Brandon C, Bookkeeping for General Contractors

Ready to try it? Start here.

Frequently Asked Questions

-

How does Striven’s transaction management improve payment processing efficiency?

+

Striven simplifies payment processing by integrating with online banking, allowing for the seamless handling of checks, electronic payments, fund transfers, and deposits. This system is designed to adapt to a variety of financial operations, making transactions straightforward and compliant with accounting principles.

-

Can Striven track every change made within the system?

+

Yes, Striven’s audit trail functionality meticulously logs every action, from keystrokes to clicks, ensuring that every transaction and modification is recorded. This level of tracking promotes transparency, enhances security, and supports compliance by offering detailed insights into user activities and data changes.

-

What safeguards does Striven have against transaction errors?

+

Striven users can enable detection and alert systems to identify and address discrepancies in transactions. This approach minimizes the risk of errors affecting your financial records, enhancing the integrity of your financial management process.

-

How does Striven handle tax management for businesses?

+

Striven offers a robust sales tax management feature that allows for the setup of custom tax agencies, ensuring accurate tax collection and remittance. Businesses can manage state, city, and other taxes efficiently, with features designed to comply with diverse tax regulations.

-

Is Striven’s transaction management feature customizable to fit different business needs?

+

Yes, Striven’s system is highly customizable, allowing businesses to tailor features such as audit trails and tax settings to their specific needs. This flexibility ensures that companies can set up the system in a way that best fits their operational requirements and compliance obligations.

-

How does Striven ensure the security of transaction data?

+

Striven incorporates advanced security measures, including real-time monitoring and alerts, to protect against unauthorized access and financial fraud. The system’s commitment to data security is evident in its comprehensive logging of user activity and changes, ensuring that all transaction data remains secure.

-

7. Can Striven integrate with other financial software and systems?

+

Striven offers a variety of integrations and connected applications, which you can read more about right here.

-

How does Striven support compliance with financial regulations?

+

Striven’s transaction management system includes features such as detailed audit trails and tax management, which are crucial for maintaining compliance with financial regulations. The system’s ability to track changes across all modules and generate compliance reports simplifies adherence to legal and industry standards.

Striven's Got You Covered

Whatever your business, Striven is here for you, making your workweek just a little easier.