Expense Tracking

Turn every cent into a stepping stone towards your financial goals.

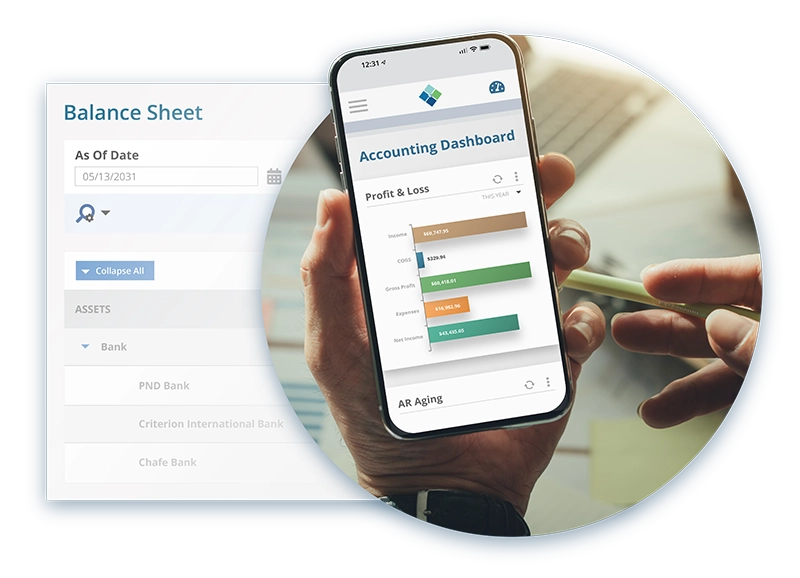

Take Command Of Your Cash Flow*

Welcome to a new era of stress-free decision making, where you have complete visibility of your resources at your fingertips.

*Striven is developed and rigorously tested to be compliant with Generally Accepted Accounting Principles (GAAP).

Smart Resource Management

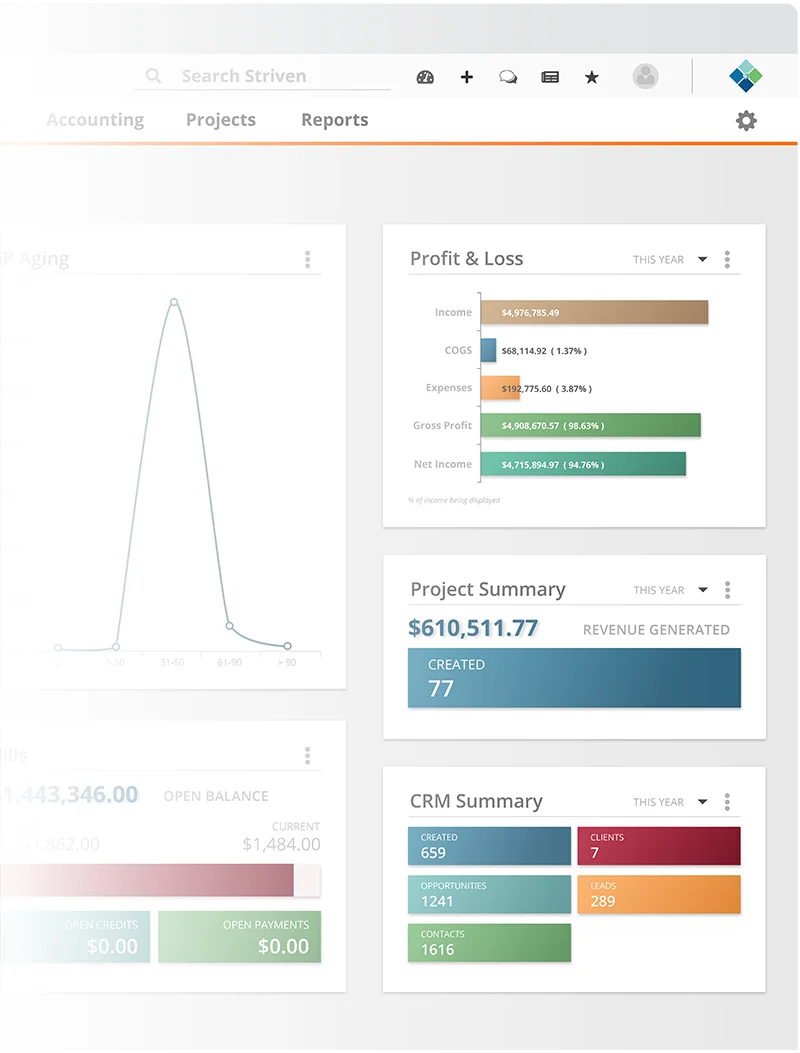

Our customizable alerts, detailed reports, and visually engaging analytics further enrich your experience, turning financial management from a chore into an empowering activity.

- Smart Categories

- Real-Time Insights

- Financial Integration

- Data-Driven Budgeting

- Visual Analytics

- Customizable Alerts

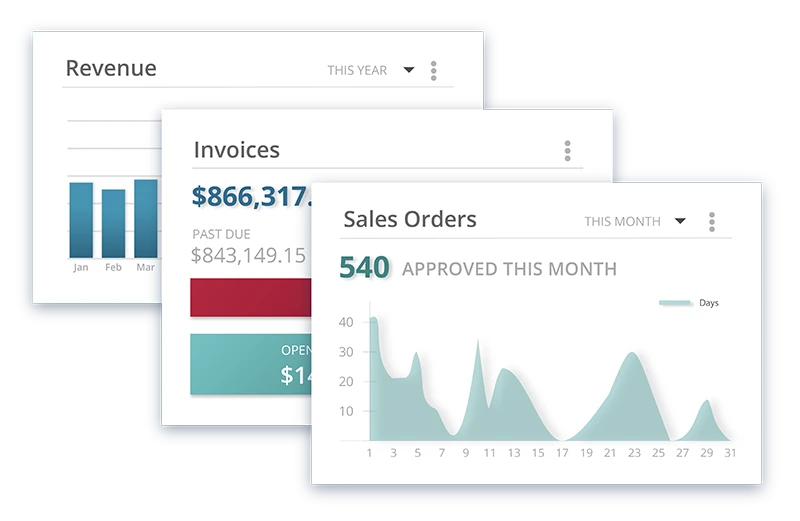

Effortless Cash Flow Management

Transform your financial journey with Striven, bringing clarity to your transactions, optimizing your spending, and accelerating your savings.

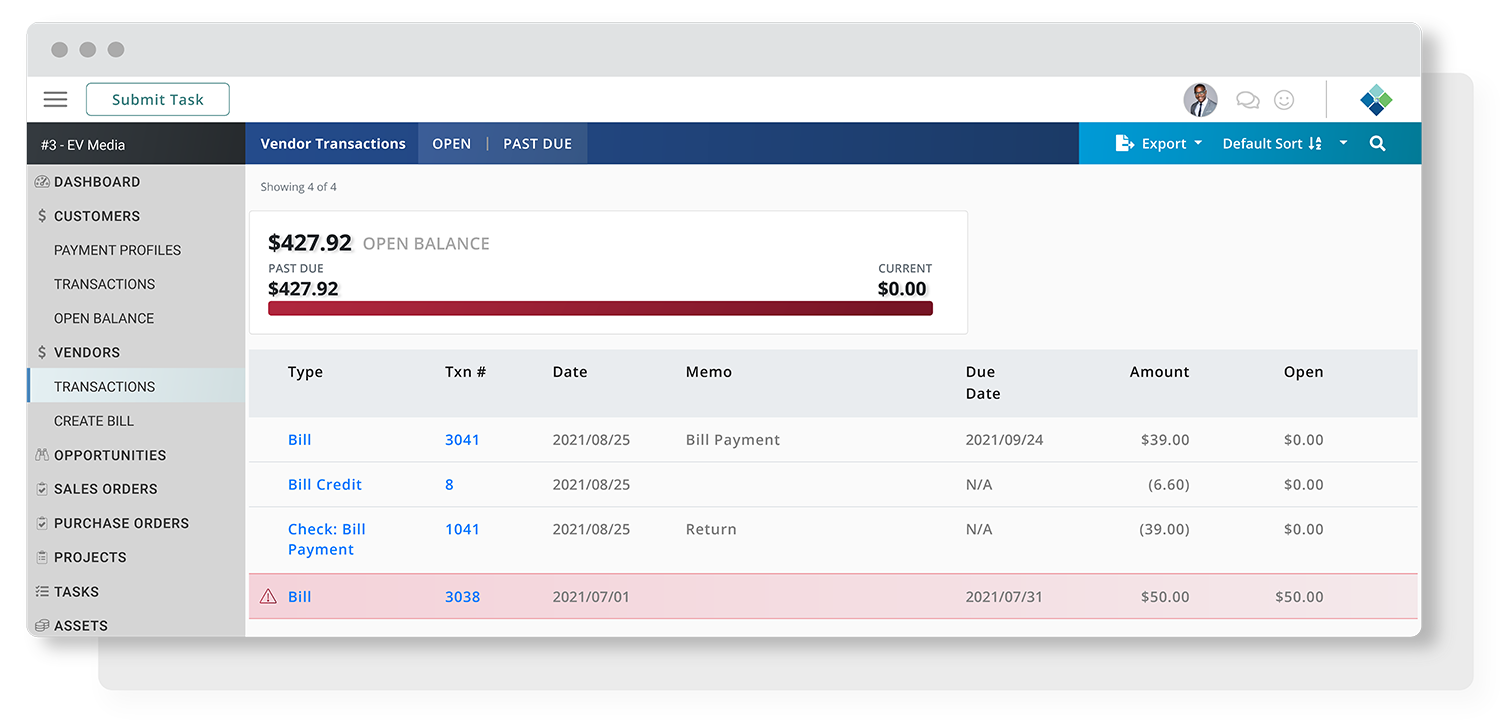

Smart Categories

Automatically sort your transactions into predefined categories, making it easy to understand where your money goes and helping you adjust your spending habits.

Real-Time Insights

Get real-time updates and overviews of your spending and saving, allowing you to make informed decisions at a glance and keep up-to-date with your financial health.

Financial Integration

Connect effortlessly with your bank accounts, credit cards, loans, and more. Experience unified financial management in one centralized, secure platform.

Data-Driven Budgeting

Generate dynamic, easy-to-follow budget reports based on your income, spending patterns, and financial goals. Empower your business with a clear path to YoY profitability.

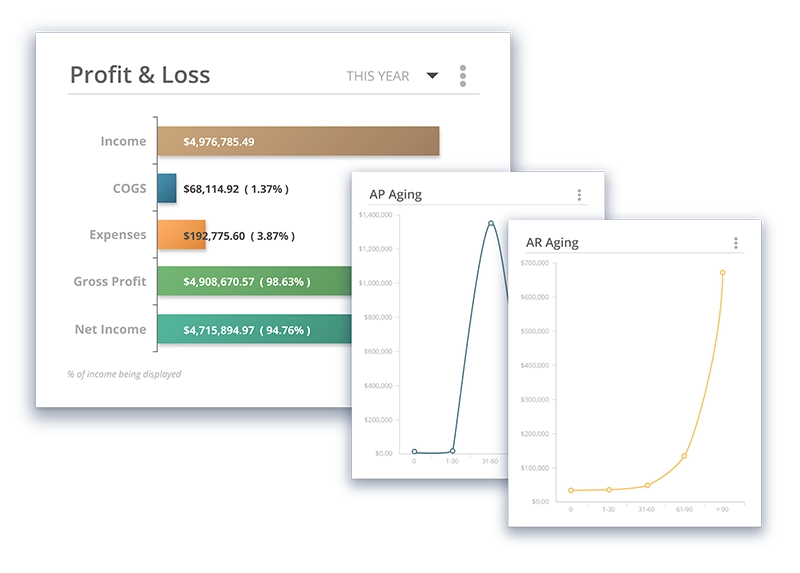

Visual Analytics

Understand your financial landscape with interactive charts and graphs.

Visual analytics help you instantly grasp your spending trends, income fluctuations, and savings progress, facilitating quicker, smarter financial decisions.

Customizable Alerts

Set up personalized alerts for specific transactions, spending limits, or goal achievements, ensuring you’re always informed and never caught off guard.

“Striven makes tracking our company’s data a breeze!”

“I specifically like the report builder feature where I can configure and pull my own reports on just about anything in the system.”

—Marielle D., Customer Experience Coordinator

Ready to try it? Start here.

Frequently Asked Questions

-

What is the main purpose of an expense tracking tool?

+

The primary purpose of Striven’s expense tracking tool is to provide you with comprehensive insights into your cash flow, making it easier for you to manage your spending, savings, and overall financial health.

-

How does Striven categorize my transactions?

+

You can categorize transactions and expenses in Striven however you’d like. You can build reports by day, item, model #, channel, etc.

-

How often are my financial details updated?

+

Striven provides lightning fast updates, ensuring you always have the most current overview of your financial status.

-

Can I link multiple accounts to Striven?

+

Yes, Striven allows for seamless integration with multiple bank accounts, credit cards, and loans, centralizing all your financial information for easy access and management. You can also add as many users to the system as you’d like.

-

How can visual analytics help me manage my money better?

+

Visual analytics present complex financial data in an easy-to-understand graphical format. These visual representations make it easier to identify spending trends, track savings, and understand overall financial health, facilitating more informed financial decisions.

-

Can I segment my revenue data with Striven?

+

Yes, you can break down your revenue data into granular details using Striven’s segmentation feature. This can help you understand your income on a deeper level, by product, region, customer demographics, and more.

-

Is Striven suitable for businesses of all sizes?

+

Striven is scalable and can be beneficial for businesses of all sizes, from small businesses to bigger enterprises. The important factor is to select a product that aligns well with your business’s specific needs and growth plans.

-

Can we access invoices and bills when we’re away from the office?

+

Yes, Striven is cloud-based, meaning you can access your documents from anywhere with an internet connection, on multiple device types.

-

Does Striven require a lot of technical knowledge to operate?

+

Striven is designed with user-friendliness in mind. You don’t need to be super tech-friendly to use Striven to it’s fullest potential. We will provide training, tutorials, and customer support to help you get the most out of your experience.

-

Can Striven’s software be used for subscription-based businesses?

+

Yes, Striven is perfect for subscription-based businesses. It can handle recurring billing, automate invoicing, and send reminders for upcoming payments, making it a great solution for managing subscription revenues.

Striven's Got You Covered

Whatever your business, Striven is here for you, making your financial management a breeze.